Why this Nvidia stock is nosediving today

December 08, 2025

CoreWeave (NASDAQ: CRWV), one of Nvidia’s (NASDAQ: NVDA) key cloud-computing partners, is under sharp pressure in pre-market trading on Monday.

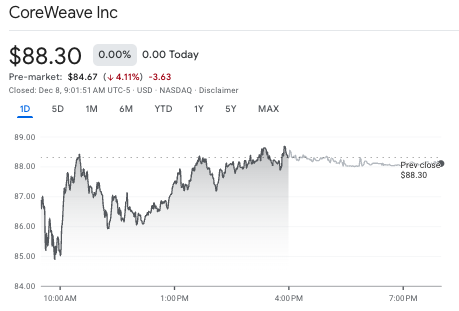

Notably, the stock has fallen 4.11% to $84.67 from Friday’s close of $88.30. The shares have traded in a relatively narrow band throughout the previous session, hovering between the high-$85s and $88 before settling near the close.

Why CoreWeave stock is dropping

The downturn was triggered by CoreWeave’s announcement that it plans to raise $2 billion through a convertible senior notes offering.

The company will issue the notes through a private offering, with the option to expand the deal by an additional $300 million. The notes are expected to carry a conversion premium of 25% to 30%, according to people familiar with the matter.

Notably, the offering is scheduled to price after Monday’s market close.

While this type of financing can provide substantial capital for expanding data-center infrastructure, it also introduces the possibility of future equity dilution once the notes convert.

For a company already scaling at high speed, the move signaled increased leverage and financial risk, prompting a swift investor reaction.

It’s worth noting that CoreWeave’s reliance on massive clusters of Nvidia GPUs places it at the center of the AI-computing ecosystem, making its financial posture something of a proxy for expectations around Nvidia-linked infrastructure demand.

Therefore, any sign of strain at CoreWeave can ripple outward, raising questions about sustainability, capital needs, and long-term profitability across the AI-compute supply chain.

Overall, whether markets view this as a necessary step to support long-term expansion or as a warning about the company’s growth pace remains to be seen.

CoreWeave, which went public in March, has drawn investors eager to capitalize on surging AI spending. The company is a key Nvidia partner and serves major clients including OpenAI and Microsoft.

Featured image via Shutterstock